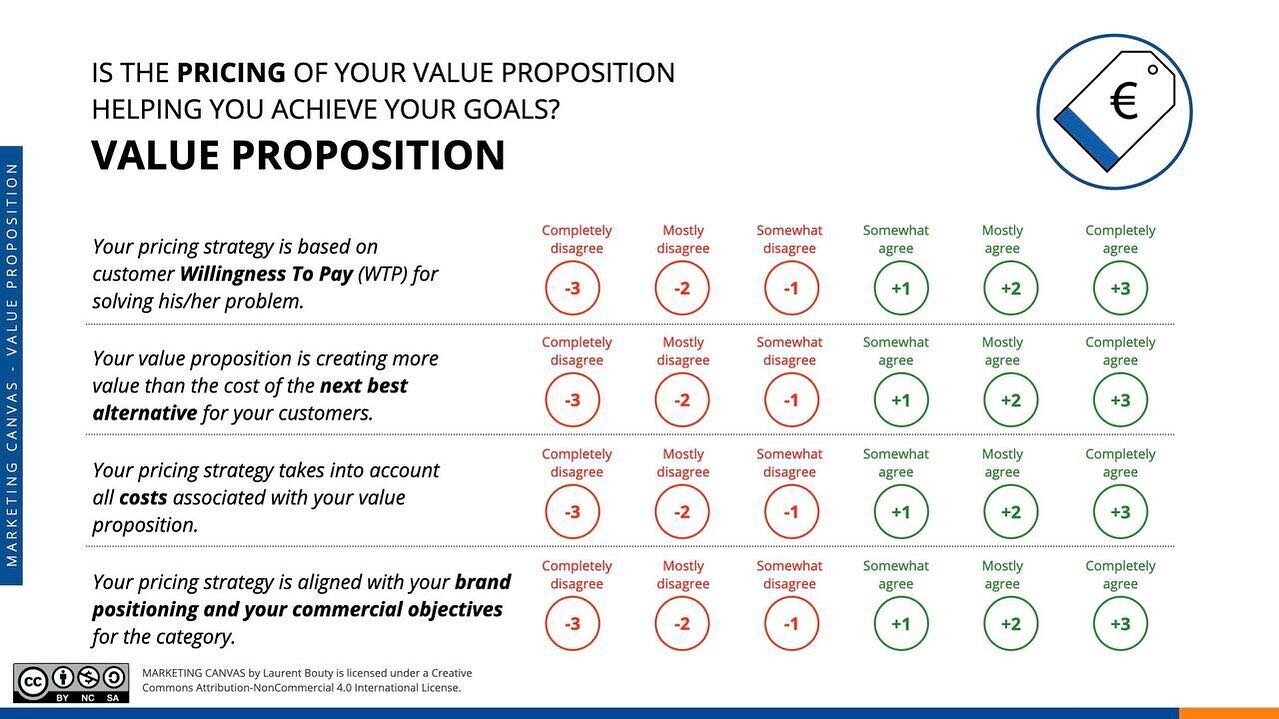

Pricing is a science and it is most of the time not considered as such except by marketing veterans. Below you can find a check-list for assessing sensitivity of pricing changes on customers.

Reference Price Effect – buyer’s price sensitivity for a given product increases the higher the product’s price relative to perceived alternatives. Perceived alternatives can vary by buyer segment, by occasion, and other factors.

How important is the expenditure (portion of income or monetary terms) for the buyer?

Perceived Risk Effect – buyers are less sensitive to the price when it is difficult to compare it to potential alternatives.

How difficult is it for buyers to compare the offers of different suppliers?

Can we compare attributes of products by observation or should we purchase and consume to learn what it offers?

Is the product new or innovative?

Is the product highly complex?

Are the prices of different suppliers easily comparable?

Switching Costs Effect – the higher the product-specific investment a buyer must make to switch suppliers (monetary and non-monetary), the less price sensitive that buyer is when choosing between alternatives.

What would be the cost of changing supplier?

For how long are buyers locked in by those products?

Have customers invested heavily in product related services (like training, customisation, ...) that would have to be repeated if they chose to switch? (example is iphone: you need to change your mp3 library from iTunes to something else or your cover, ...)

Price-Quality Effect – buyers are less sensitive to price the more that higher prices signal higher quality. Products for which this effect is particularly relevant include: image products, exclusive products, and products with minimal cues for quality.

Size of Expenditure Effect – buyers are more price sensitive when the expense, accounts for a large percentage of buyers’ available income or budget.

How important is the expenditure (portion of income or monetary terms) for the buyer?

End-Benefit Effect – the effect refers to the relationship a given purchase has to a larger overall benefit, and is divided into two parts: Derived demand: The more sensitive buyers are to the price of the end benefit, the more sensitive they will be to the prices of those products that contribute to that benefit. Price proportion cost: The price proportion cost refers to the percent of the total cost of the end benefit accounted for by a given component that helps to produce the end benefit (e.g., think CPU and PCs). The smaller the given components share of the total cost of the end benefit, the less sensitive buyers will be to the component's price.

How economically or psychologically important is the end-benefit that buyers seek from the product.

How price sensitive are buyers to the cost of that end-benefit?

What portion of the end-benefit does the price of the product account for?

Shared-cost Effect – the smaller the portion of the purchase price buyers must pay for themselves, the less price sensitive they will be.

Does the buyer pay the full cost of the product?

Perceived fairness Effect– buyers are more sensitive to the price of a product when the price is outside the range they perceive as “fair” or “reasonable” given the purchase context.

How does the product's current price compare with prices people have paid in the past for similar products?

Can any price difference be justified based upon a plausible cost difference?

Price Framing Effect – buyers are more price sensitive when they perceive the price as a loss rather than a forgone gain, and they have greater price sensitivity when the price is paid separately rather than as part of a bundle.

Do customers see the price as something they pay to avoid loss or to achieve gain?

Is the price paid as part of a larger cost or does it stand alone?

Is the price perceived as an out-of-pocket cost or as an opportunity cost?

Extract from The Strategy and Tactics of Pricing, 5th Edition. Thomas Nagle, John Hogan, and Joseph Zale. Chapter 6, Exhibit 6-4, http://en.wikipedia.org/wiki/Pricing_strategies

Marketers, Pricing can often be a confusing topic